The Future of the U.S. Dollar After the 2020 Election

2021-07-05On Thursday, the U.S. dollar continued to rise after hitting a high in more than eight weeks.

There are still 40 days to go before the U.S. election. The importance of the U.S. election trend on the dollar index is gradually increasing.

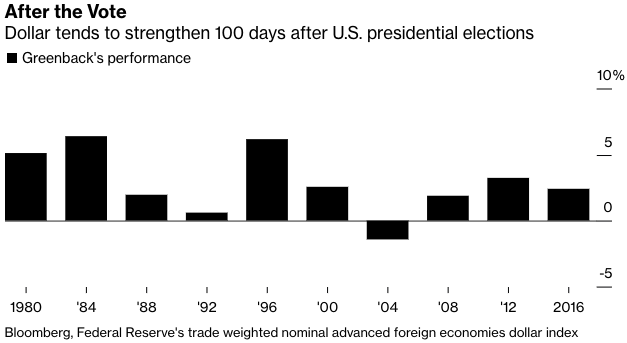

For all the forecasts about dollar weakness, history shows that the greenback is poised to appreciate after November's presidential election -- regardless of who wins.

The dollar strengthened in the 100 trading days after nine of the past ten elections from 1980 to 2016, according to Richard Falkenhall, a senior foreign-exchange strategist at SEB AB in Stockholm. The currency performed better following Democratic wins, rising an average 4% after these votes versus about 2% when Republicans prevailed, he said, noting that the 1984 and 2008 votes were excluded from this calculation due to outsized drivers beyond the election.

The U.S. Dollar After an Election

2020 has been a historic year for the U.S. dollar, with uncertainty being the only rule governing valuations.

The mass capitulation that followed the COVID-19 outbreak created a liquidity crunch―one that was quickly addressed by the United States Federal Reserve (Fed). In an aggressive series of policy moves, the Jerome Powell-led central bank launched an unlimited Quantitative Easing (Q.E.) program.

Under unlimited Q.E., the benchmark Federal Funds Target rate was cut to 0.00-0.25% indefinitely, and the FED vowed to purchase an "unlimited" amount of U.S. Treasuries as well as mortgage-backed securities. Over the summer months, the historic injection of liquidity set the stage for a slumping USD.

Increased volatility in the dollar index is high

The reason is as follows:

(1) Prospects for economic recovery will be mixed due to the COVID-19 epidemic continues. If the economic data falls short of market expectations, it can cause short- and long-term fluctuations in the market.

(2) The market will have fluctuation for an "unexpected event," especially as the election approaches. Such as the Hillary Clinton email controversy in 2016.

(3) Growing Friction in US-China Relations.

The U.S. Dollar is difficult to continue to strengthen

At present, the recovery of the U.S. economy is slower than that of the eurozone. If the euro strengthens, it will suppress the dollar index.

Fed launched an unlimited Quantitative Easing (Q.E.) program also put pressure on the U.S. dollar index.

Biden win could accelerate dollar's drop

How the markets respond to the election will be determined by three factors: the stance of fiscal policy and the size of the budget deficit, the tax, and regulatory environment and foreign policy.

"We continue to see a good case for sustained dollar weakness, reflecting the greenback's high valuation, deeply negative rates in the U.S., and a recovering global economy (which tends to weigh on the currency because of its unique global role)," wrote a Goldman Sachs team led by Zach Pandl, co-head of global foreign exchange, rates and emerging markets strategy. "A Democrat sweep in the U.S. elections could likely accelerate this trend."

A so-called blue wave if Biden wins the White House and Democrats picked up a net three seats in the Senate while maintaining control of the House of Representatives would result in "easier fiscal policy and a larger budget deficit" than any of the other outcomes, the Goldman team said.

Biden has proposed reversing at least some of President Trump's corporate tax cuts, which could weigh on U.S. gross domestic product and make U.S. stocks less attractive to international investors. Goldman's research suggests both could impact future foreign exchange returns.

Another round of fiscal stimulus when the Federal Reserve has promised to keep interest rates low would put further pressure on the dollar, the firm said.

Marc Chandler, chief market strategist at the trading firm Bannockburn Global Forex, agrees the dollar is headed lower no matter who wins the election.

He believes the dollar is just starting a long-term downtrend and will approach its 2008 low of 1.60 per euro.

Essentially, the strong vs. weak USD discussion boils down to political and COVID-19 uncertainty. No matter which side you're on, Fed policy, social unrest, and political turnover are poised to play key roles in the value of the U.S. dollar after Election 2020.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano